However, any income produced by the gift after it is received by the donee is considered earned income and must be reported.

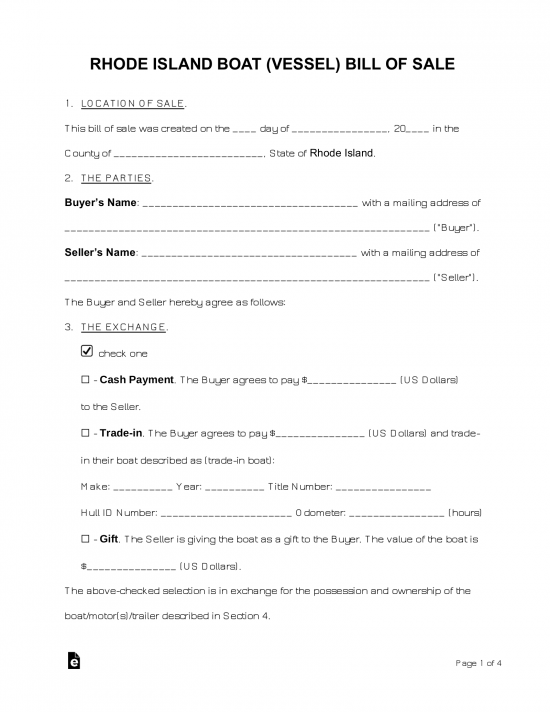

The donee does not report any gifts received on his income tax return. A gift tax return (IRS Form 709) must be filed every calendar year a transfer by gift is made.Īre gifts considered income by the donee? Generally speaking, no. Who pays the tax on a gift? Generally speaking, the donor is generally responsible for paying any tax associated with a gift.

Gifts to qualified religious, political, educational and other IRS qualifying organization.Gifts to your spouse (unless spouse is a not a US citizen).Payments of tuition or medical expenses for someone else made directly to provider or institution.Gifts not exceeding the amount of the annual exclusion.Generally speaking, any gift is a taxable gift.

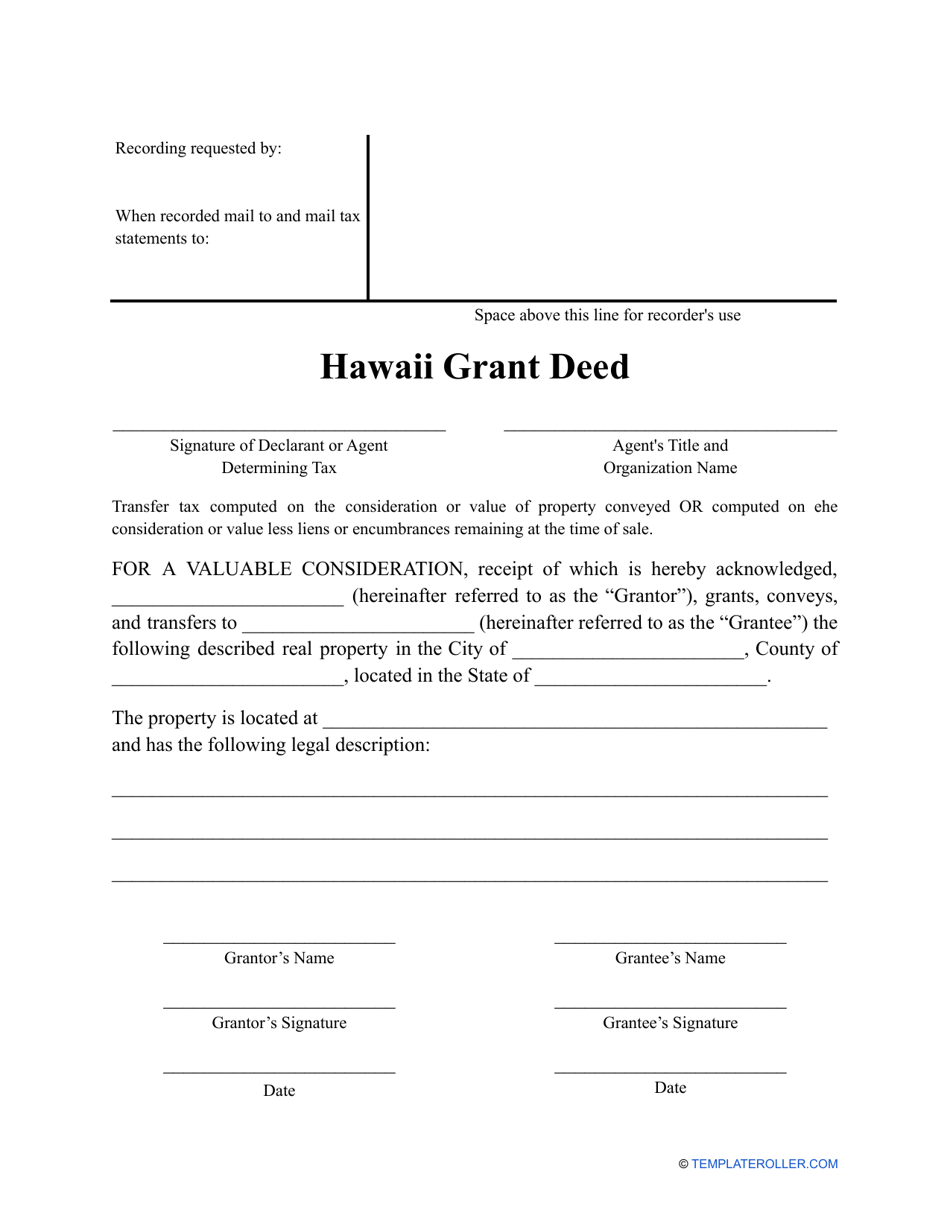

HAWAII CONVEYANCE TAX FULL

Furthermore, a gift must be a "present interest", which is "an unrestricted right to the immediate use, possession, or enjoyment of property or income from property." Examples of gifts may be selling something at less than full market value or making an interest-free/reduced interest loan. What is a gift? A gift is any transfer of property, made directly or indirectly, from one individual to another where the individual receives nothing or less than full market value in return. The federal government taxes gifts to prevent people from transferring all their wealth and money tax-free before they die, thereby escaping any estate taxes. In this post, we'll review some of the basics of gifting and the federal gift tax. Gifting property is a valuable estate planning tool, especially for those who wish to reduce their taxable estate.

0 kommentar(er)

0 kommentar(er)